maryland digital advertising tax

Ad Be seen where your customers are searching browsing and watching with Google Ads. Lets back up a minute.

Indirect Tax Kpmg United States

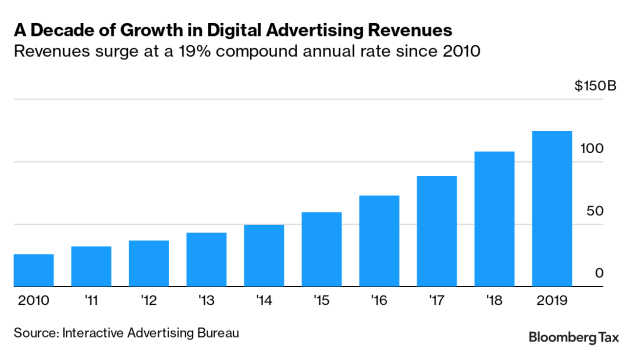

Some of these impediments are unique to the way Maryland crafted its law while others are inherent to the notion of a digital advertising tax however designed.

. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB. Or two years as the case may be. Achieve up to a 21 return on ad spend while staying within your budget.

The override of this bill will allow for a new tax to be imposed on digital advertising effective for tax year 2021. The tax rate ranges from 25 to 10 and applies to the taxpayers global annual gross revenue from digital advertising services in Maryland. Maryland is fast-tracking a measure that would push the start of the digital advertising.

Maryland House Bill 732 2020 session imposed a special tax on gross revenues received from digital advertising services and House Bill 932 2020 session expanded the. When is something a tax for purposes of the. Overriding the governors veto of HB.

The tax applies to annual gross revenue derived from digital advertising in the state and is imposed. Ad Be seen where your customers are searching browsing and watching with Google Ads. The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising.

The Maryland Legislature overrode a Governors veto last month of House Bill 732. The Maryland Comptroller of the Treasury has adopted new regulations providing guidance on the revenues derived from digital advertising services computation of the tax and. Tax on digital advertising services enacted Marylands legislature on February 12 2021 voted to override the governors veto of legislation imposing a new tax on.

In March 2020 Maryland lawmakers adopted legislation. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. Maryland has enacted the nations first tax targeting digital advertising as the House on February 11 and the Senate on February 12 overrode Governor Larry Hogans R veto of 2020 HB.

Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on October 8 2021. In March 2020 Maryland lawmakers adopted legislation. Or two years as the case may be.

Lets back up a minute. Hague on December 3 2021. Marylands first-in-the-nation gross revenue tax on digital advertising took effect on March 14.

In order to be subject to the tax a taxpayer. Achieve up to a 21 return on ad spend while staying within your budget. 732 on February 12 2021 making.

Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland. Maryland Digital Advertising Tax Litigation Focus Moves to State Courts. Update March 9 2021.

And Marylands legal position remains a precarious one. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues pulled in by large. Kranz Eric Carstens and Jonathan C.

The statutory references contained in this publication are not. Maryland Enacts New Tax on Digital Advertising. Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations.

And Marylands legal position remains a precarious one. Maryland becomes first state to adopt a digital advertising tax. The Digital Tax imposes tax on gross revenue derived from digital advertising services in Maryland at graduated rates from a minimum of 25 to a maximum of 10.

Digital Advertising Taxes Eversheds Sutherland

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

Amazon Facebook Google Back Lawsuit Against Maryland S New Online Ad Tax The Washington Post

Taxnewsflash Digital Economy Kpmg United States

Maryland Lawmakers Approve New Digital Tax Which Critics Contend Will Undermine U S Pushback Against Foreign Digital Tax Efforts

Maryland Expands Tax On Digital Goods Sales Tax Institute

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

The Best Digital Marketing Agencies Of 2022 Digital Com

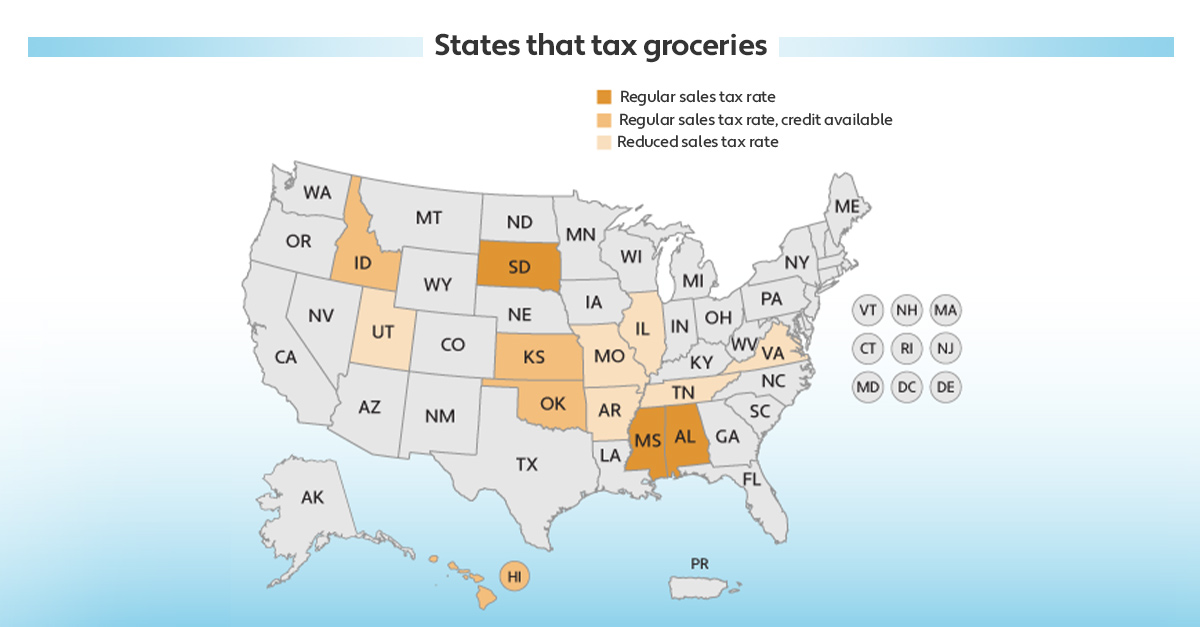

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Taxnewsflash Digital Economy Kpmg United States

The Lancet And Financial Times Commission On Governing Health Futures 2030 Growing Up In A Digital World The Lancet

Lauren Loricchio Laurenloricchio Twitter